The Net Effect of Covid, War, Inflation and Global Supply Chain Challenges On The Office Ergonomics Market

Like most reviews sites, our editorial staff and laboratory testing expenses are partially offset by earning small commissions (at no cost to you) when you purchase something through those links. Learn More

Ever since the outbreak of the pandemic we’ve been reporting on the Impact of COVID-19 on the Office Fitness Industry, and Standing Desk Suppliers in Particular and on How COVID-19 Reshaped the Office Furniture Industry Overnight. But two years in now, and with the Russian offensive in Ukraine adding even more strain to an already buckling global supply chain, we thought it would be a good time to reassess how the office ergonomics industry has been coping with it all.

So we again surveyed dozens of industry CEOs and did a comprehensive update of a few hundred reviews of standing desks, treadmill desks, standing desk converters, monitor arms, keyboard trays, balance boards, standing mats and other ergonomic accessories to see how prices and selection have been affected.

What we learned wouldn’t surprise any economist because there’s nothing fundamentally different about our corner of the manufacturing sector than any other. Like most, it’s dominated by companies that are either based in Asia or source their products in Asia (predominantly China), and so the vast majority of products have seen significant price increases due to dramatically spiked deep ocean freight costs, holding tariffs and spiking raw materials and labor costs worldwide—as well as frequent stock outages and backorder delays.

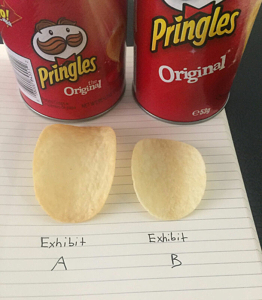

Shrinkflation has been a common tactic being used by some standing desk and treadmill desk manufacturers to keep their “original” prices but in fact deliver less for the money than they used to.

Shrinkflation has been a common tactic being used by some standing desk and treadmill desk manufacturers to keep their “original” prices but in fact deliver less for the money than they used to.Along with this, we’ve noticed two other accompanying phenomena. One is “shrinkflation,” where some manufacturers held prices down by including less in the product than they used to in the past, or lowered the quality of the components they use in those products. We’ve seen everything from lower-powered motors in standing desk lifting columns to thinner steel and lighter decks in office treadmill frames. In one case, Lifespan Fitness surreptitiously changed all the specs on their underdesk treadmills without changing their model numbers at all, so that any reviews of their products were no longer really relevant but of course still being used in their advertising and promotions.

The other shrinkflation tactic that’s been apparent to us, given how many mailing lists we’re on, has been the relative absence of sale promotions compared to what used to be the norm. Fierce competition between online sellers used to manifest in a barrage of deep discount sales promotion campaigns on a regular basis—not just on Cyber Monday. That practice slowed way down as margins got squeezed and sellers attempted to hold the line on raising their retail prices. We saw a short-lived barrage of discount sales again at the start of the Russian-Ukrainian War to draw consumers back away from their TV sets, but that’s not likely to sustain for long as energy and raw materials costs are spiking up yet again as a result of that world event.

Speaking of Russia, if you were keen on a standing desk made with Baltic birch—a hot little niche standing desk category we recently reviewed a bunch of products in—that wood comes mostly from Russia, and will likely not be seen again in this country for a long time. Once existing wood stocks are used up, desks like the Captain’s Desk and Ensign’s Desk will sadly be suspended from production, we are told.

Thinning of the herd, as the “race to the bottom” takes its toll

Of course, the pandemic took a lot of businesses down, not just human lives, and there have been many departures from the field of competition in our industry sector as in so many others. The Dead Pool continues to expand, and as we reported in our recently refresh round-up of the top Treadmill Desk Workstations, the majority of brands and models that we’ve reviewed over the past decade, indeed that have been in the market for the past 15 years, have exited the stage.

Of the few makers of under-desk office treadmills hanging on, most are barely doing so, despite the fact that treadmill desks were truly “having their moment” during the pandemic. They’re just very difficult to get right now, like all fitness equipment, and have become much more expensive due primarily to the steep rise in ocean shipping costs. The long-time market leader in the category, Lifespan Fitness, has seen its US founders and management team depart en masse and the company taken over by its Taiwanese supplier, dramatic shrinkage in component quality of its products (and as mentioned above, without even changing model numbers or flushing out old user reviews no longer relevant), significantly increased retail price, the literal removal of factory warranty coverage from the base price, and an atrocious degradation in customer service and customer reviews over the past couple of years.

InMovement bankrupted and its shell was sold to a mom-and-pop that then acquired the UnSit treadmill from its bankrupted founder; now selling it for top dollar, and only on the rare occasion of being in stock. Only one player, iMovR, has maintained its top-notch product quality and service quality reputation while continuing to invest in innovation and introducing new products in the category.

In the standing desk sector, we saw dozens of major retailers (e.g. Best Buy, Home Depot) and digitally-native online retailers (e.g. Amazon, Walmart) jump further into the fray chasing after their slice of the burgeoning Work-From-Home (WFH) market, including the likes of Big Furniture (Steelcase, Herman Miller, et al), bidding up the cost of advertising on major keywords like “standing desk” and snuffing out hundreds of smaller competitors who could no longer afford to stay in the game.

There has long been a “race to the bottom” as Chinese standing desk manufacturers clobbered each other to win the most customers over a $5 difference in price. Most of those have existed on Amazon, where the average standing desk is now priced at around $250 and if you bought one, you’d be lucky if it lasted a year, much less operated properly out of the box (read our cautionary tales if you’re considering this). There’s no doubt that the majority of standing desks sold in the USA are in fact these commodity-grade products sold through Amazon. If you’re reading this article it’s probably because you’re not the kind of consumer who makes an important purchase decision like this without doing some research first outside of the Amazon ecosystem—so, good for you. Read on…

At least one major brand that built up its market share on Amazon first and then invested in building its online presence outside of their ecosystem is Flexispot, which now joins Autonomous, Uplift and Fully as one of the four fiercely competitive e-commerce juggernauts in the standing desk business. These four alone now spend over $100M a year on search advertising between them according to our sources at Google, and at least three of them have extremely deep-pocketed backers (as in billionaires or multi-billion dollar corporations). The standing desk market has absolutely exploded with the WFH boom, but so has the competition.

To be a real player in the mainstream, commodity-grade, high-volume middle of the standing desk market nowadays you need to be able to bring at least 8 to 15 million visitors to your website a year. That leaves the majority of brands in the industry smaller niche markets to go after where they won’t have to compete with the heavies. Ironically, the one name that may eventually be dropping off from this group, Fully, was acquired three years ago by the largest office furniture company in the world, Herman Miller—but as often happens in these acquisitions it seems to have lost its mojo after the founder cashed out and hit the silk in 2021.

The one thing that these four have in common? Their prices, or what you used to get for their prices, are definitely not what they used to be. Autonomous and Flexispot have dramatically increased their prices from a year or two ago, lifting themselves out of the range of all those Amazon sellers and squarely into the range of the “Jiecang pack” (namely Fully and Uplift, as well as Evodesk but they seem to be submerging now, unable to afford to stay in the battle). Uplift and Fully stopped running constant discount sale promotions. On all their sites we see frequent outages of colors and sizes of certain desks as ports continue to remain clogged (all these products are made in China).

Flexispot has been the most outlandish in its assault on the other three, recently building a new website that’s practically a photocopy of Fully’s, using some of Uplift’s product names and mirroring some of Autonomous’s price points. Will Miller Knoll (f.k.a. Herman Miller, which now owns Fully) sue Flexispot over intellectual property rights? We’re not legal experts here but that seems like a stretch, especially against a Chinese company that clearly doesn’t have the same regard for copyright and patent laws as we do in the US. It’s almost the “perfect crime.”

Suffice to say these four are focused almost entirely on brinksmanship with each other now and little else. At least in the commodity-grade end of the market, it’s clear that the industry is reaching a maturation phase where oligopolies are forming and small vendors will have a very hard time gaining market share (indeed many have chosen to sell out to larger firms, especially as private equity firms have moved into the industry; e.g. StandDesk, Fully, Anthro to name but a handful). Everyone else in the market is an ankle biter now, or in a protected niche like American-made, premium-grade.

So where’s the good news?

Between tariffs and the supply chain woes invoked by both the pandemic and the war, the playing field has been tilted away from cheap Chinese imports like never before, significantly narrowing the gap between commodity-grade and American-made, premium-grade standing desks.

Between tariffs and the supply chain woes invoked by both the pandemic and the war, the playing field has been tilted away from cheap Chinese imports like never before, significantly narrowing the gap between commodity-grade and American-made, premium-grade standing desks.If you’ve been a subscriber for any period of time you know we’ve long been proponents of buying American, and never more so than since the tariffs and the pandemic kicked in. There’s just no comparison in quality between commodity-grade, Chinese-made and premium-grade American-made, standing desks. Not only will China not likely catch up with US brands in quality or innovation anytime soon, but the major producers in China have also been going in the other direction the past couple of years, understandably looking for ways to offset the constant inflation in costs resulting from the pandemic economy, and now the war economy on top of it—and tariffs even before either of those kicked in.

Not that the few domestic producers haven’t had their continuous supply challenges and inflationary pressures to deal with, too. Domestic freight has not only gotten ridiculously expensive, all the parcel and freight carriers have had a horrible time retaining drivers, getting enough trucks and delivering anything on time these days. That affects the entire supply chain, not just the final delivery of the finished product to the customer. Costs for everything from wood to cardboard to steel to chips is up and still climbing month to month with inflation, domestically as well as globally. But at least the domestic manufacturers, such as iMovR, do not have to deal with deep ocean freight on their standing desk products, eliminating the biggest source of cost and delay increases.

All these inflationary pressures against overseas manufacturers have helped tilt the playing field back in favor of American-made, premium-grade standing desks, narrowing the price gap more than ever.

All these inflationary pressures against overseas manufacturers have helped tilt the playing field back in favor of American-made, premium-grade standing desks, narrowing the price gap more than ever.So one way to look at the situation is that the playing field has been tilted quite a ways in favor of domestically-manufactured standing desk products—which were historically significantly more expensive than the imports, and are now much closer in price than ever before. From a value standpoint, they compare even more favorably than before given their generally higher quality of components and better customer experience overall.

Another positive trend we’ve been monitoring is an increasing number of new products coming into the US market from Europe as opposed to Asia. The new Gymba balance board from Finland and new standing desks that’ll be hitting the market in May 2022 based on an exciting new “brushless DC motor” lifting base technology from Austria-based OEM manufacturer LogicData are but two examples we’re writing about right now. While Asian manufacturers seem to have put virtually all their energies into engineering cost efficiencies rather than product innovations, we are glad to see American and European companies continuing to march forth with good old fashioned innovation, taking advantage of the lull in product development activity in the far east.

Lastly, we’re glad to see Room-of-Choice and similar “white glove” delivery upgrades returning. These were suspended by most standing desk and treadmill desk manufacturers during the Covid lockdowns but are coming back now.

0 Comments

Leave a response >