Congress Just Raised the Special Tax Deduction for Standing Desk and Treadmill Desk Equipment to $510,000

- Must Read

If you operate a business, or earn a significant portion of your living working from your home office, your acquisition of a standing desk or treadmill workstation is very likely a tax deductible expense. Consult your tax or accounting adviser to verify, but there may be a very strong incentive to purchase a treadmill desk system before the end of the year depending on your situation.

Expiring Soon – IRS Section 179 Tax Benefit for Office Equipment

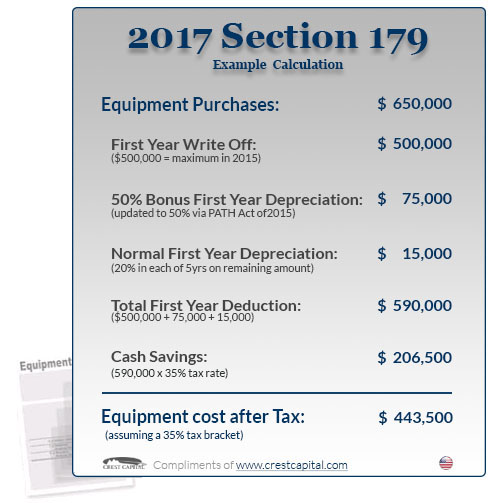

Businesses have significant reasons to acquire and install capital equipment before the end of this year, thanks to Section 179 of the Tax Code. For the current tax year, Section 179 has been dramatically increased to $510,000 in 2017!

Things to know:

- 2017 Deduction Limit = $510,000

This deduction is good on new and used equipment, as well as off-the-shelf software. This limit is only good for 2017, and the equipment must be financed/purchased and put into service by the end of the day, 12/31/2017. - 2017 Spending Cap on equipment purchases = $2,030,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive.” - Bonus Depreciation: 50% for 2017

Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. Note: Bonus Depreciation is available for new equipment only. - This can have a DRAMATIC effect on tax savings and, in essence, DRASTICALLY reduce the overall cost of equipment purchases while buying equipment and all end-of-year vendor incentives that likely exist still apply as well.

Here’s a summary of the changes to Section 179 for 2017:

Businesses: check here if you need to confirm shipping lead times on any particular equipment, or inquire about leasing options.

WorkWhileWalking.com does not offer accounting, tax, or legal advice but we do urge you to discuss this with your accountants to see if major tax savings apply to you this year.

If you’re reading this blog post near the end of the calendar year then don’t delay – speak to your tax and accounting advisers today to maximize these tax incentives this year – and make next year the one to restore health and vitality to your workday!

1 Comment

Leave a response >